Retail peak 2024: how to successfully navigate the challenges and opportunities ahead

As autumn creeps in, there’s one thing on our mind: Black Friday is just around the corner. Awin’s partnership development director, Joelle Mullin, shares her five-point checklist for e-commerce success next month. Plus, key considerations you need to make when finalizing your peak-season strategy and a deep dive into sector trends.

Black Friday, scheduled for November 29, is the most anticipated retail event of the year. Whether you’re a retailer or a consumer, we’re all marking the date in our diary, planning budgets and forecasting the deals on offer. The extended period surrounding Black Friday represents a critical moment for brands. Don’t miss the boat, here’s five things you need to add to your strategy if you want to make the most of this consumer enthusiasm.

Your peak plan: our strategic recommendations

- Optimize for mobile: with mobile share of sales at 69% in 2023, and expected to rise, ensure that your mobile shopping experience is seamless. App attribution is integral if retailers have a shoppable app to measure and capitalize on customers across mobile.

- Embrace omnichannel retail: Black Friday is gaining increased traction in-store, with Mintel reporting that 44% of consumers made in-store purchases during the event last year. Integrate online and offline strategies to capture a broader audience from card-linked offers to geo-targeting customers shopping on the high street.

- Plan for promotions: given the prevalence of earlier deals, strategize your promotions to stand out and attract shoppers who may have already started their holiday shopping. During Black Friday 2023, Awin saw 56% sales using a voucher code.

- Focus on customer retention: with tighter margins and ad spend, enhance your marketing efforts to build loyalty and encourage repeat business. Brand partnerships can be an effective way to boost customer loyalty and enhance the shopping experience, especially when offering value-added rewards at checkout. Subscription models are also gaining traction, providing an opportunity for sustained engagement. Black Friday offers on ongoing subscriptions could further drive long-term retention.

- Maximise growth with affiliates: continue to focus on affiliate marketing, with partner diversity from CSS to influencers, and a strong ROAS, this is a channel that is outperforming e-commerce overall.

Ready to perfect your peak-season strategy? Don’t get caught out. Here are four things you should keep in mind when planning for next month.

Peak considerations: what to keep in mind

- A second Prime Day in October: this year’s October is expected to feature another Amazon Prime Day, offering customers an opportunity to start their gifting shopping early. While this could distribute Christmas spending more evenly for consumers, it may affect the overall Black Friday sales figures for November.

- The timing of Black Friday: Black Friday will occur later this year, aligning with many people’s paydays. This timing could boost spending as consumers have more disposable income available.

- Supplementary strategic peaks last year: ‘Fake Friday’ – the Friday before Black Friday – saw significant sales spikes. Retailers should consider this day as a key opportunity to capture shoppers early. Additionally, Singles’ Day on November 11 also demonstrated strong performance. Leveraging these peaks can enhance overall monthly sales.

- Rising consumer confidence: consumer confidence is gradually improving, reaching a near three-year high, which could stimulate spending, although interest rates in 2024 remain a factor to watch.

Black Friday: what can we learn from last year?

When building out a comprehensive plan for your peak season, it helps to take a look back at the previous year’s performance. In 2023, the retail sector enjoyed a notable boost during Black Friday. Mintel reported a 7.3% increase in Black Friday sales in the UK, reaching £13.3bn.

Things get interesting when you compare this to the affiliate channel, where performance exceeded that of traditional e-commerce. Overall retail revenue increased by 8.8% year-on-year, with Black Friday alone seeing a 10% surge in revenue.

In 2024, we’re presented with a very different landscape. Year-to-date growth has slowed to 3%, a significant drop from the robust +10% Black Friday last year. This slowdown raises the question: can we expect a repeat of last year’s success?

How is the retail sector fairing in 2024?

The retail environment in 2024 is showing mixed signals. Online retail now constitutes 26.2% of total sales according to the Office for National Statistics. This figure surges during peak trading periods. In November 2023, online sales reached 30.7%, underscoring the importance of a strong Black Friday e-commerce strategy.

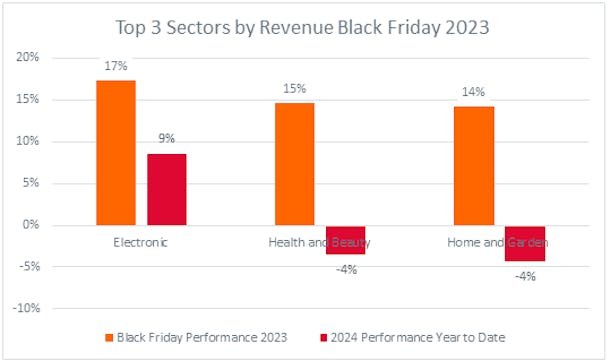

Top-performing sectors last year at Awin included electronics, health and beauty, plus home and garden. All experienced double-digit growth. This year, however, performance tells a slightly different story.

It looks like the lipstick effect is finally wearing off; the health and beauty sector is down -4% year to date. Home and garden is also down -4%. Like the beauty sector, home and garden rode the wave of lockdown trends long after the pandemic was over, but the sector’s blossoming performance is starting to see stunted growth. This shift in revenue performance across these categories will undoubtedly have an impact on the peak event’s performance overall.

The affiliate channel: the essential tool in your Black Friday strategy

Joining Awin back in 2010, I’ve seen the channel grow in size and reputation. We’ve diversified and thrive in an ever-evolving retail environment. In my role as partnership development director I am fortunate enough to work alongside a team of specialists who lead the local strategy for global growth initiatives. Here are my predictions for Black Friday 2024.

Despite a slower growth rate earlier in the year, there are positive indicators for Black Friday 2024. If I were to place my own bets, I’d predict a 4.5% increase in revenue for Black Friday this year, reflecting a modest growth trend compared with the current year-to-date performance. This forecast includes a 4% increase in sales year-on-year and an average order value (AOV) rise of approximately £10 from 2024’s current AOV of £76.5.

As we approach Black Friday 2024, adapting to the changing retail landscape will be crucial for success. Affiliate marketing has proven to be a leading strategy for online retail and can also enhance mobile and in-store efforts, helping retailers maximize peak performance across all channels. Despite a tougher-than-expected year for UK retail so far, peak performance predictions remain positive on the affiliate channel.

Awin can support your brand this peak season, and beyond. Discover what we can do for your business.

Joelle Mullin – partnership development director