Streaming TV has finally become profitable – by returning to the cable playbook

Disney recently joined Warner Bros Discovery, Paramount+, and Netflix in the ‘finally profitable’ club. How? By increasing prices and acting more like the traditional providers they replaced, says Wes Morton.

Streaming services have recently found the recipe for profitability - you might recognize it / Creativ Strategies

2024 is the year that streaming TV finally achieved profitability.

Disney recently announced that its streaming business (consisting of Disney+, Hulu, and ESPN), achieved $47m in operating profits in Q3, raking in a staggering $6.4bn in revenue.

With that announcement, Disney joined WarnerBros Discovery and Paramount+, both of which reported their own first years of profitability back in Q2: $103m and $26m respectively. Netflix which reported a net profit of $2.15bn, surging 44% in Q2 following the introduction of an advertising-supported plan and a password sharing crackdown.

Ironically, the major changes these media companies have made to generate profitability emulate practices that made traditional TV profitable for the last 50 years. Media’s new-found streaming TV profits derive from increased subscription prices, consolidation bundling, reduced originals, and (reintroduced) ads.

Want to go deeper? Ask The Drum

Increased subscription prices

Say goodbye to streaming subscriptions under $10. Pre-pandemic subscriptions, priced below market value, were loss leaders for media conglomerates to acquire customers as rapidly as possible.

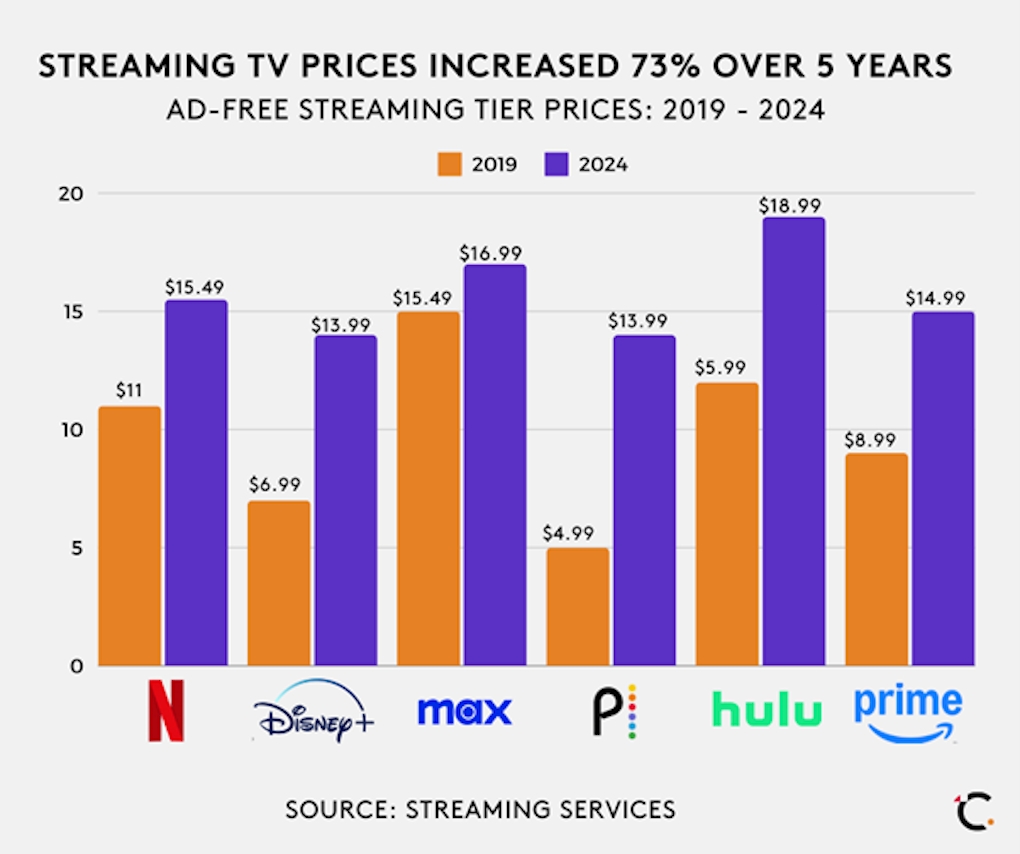

In 2019, Disney launched Disney+ for $6.99. Netflix was $11. HBO Max, soon to be rebranded to MAX, launched at $14.99. Peacock cost just $4.99 per month. Hulu had a $5.99 (ad) and $11.99 (ad-free) tiers. Prime Video cost just $8.99.

That’s $59 a month to own them all.

Now, five years later, those streaming TV subscription costs have risen by 73% on average. The ad-free tiers now cost $13.99 for Disney, $15.49 (or $22.99 for premium) for Netflix, $16.99 for Max, $13.99 for Peacock, $18.99 for Hulu, and $14.99 for Prime Video.

That’s $102 per month, total. Roughly the same as the average cable bundle at $110 dollars a month. And expect future increases; each firm has either announced or already enacted price hikes in 2024.

More consolidation and bundling

This new power to simultaneously increase subscribers and prices came after a wave of consolidation in the media industry.

Viacom acquired Pluto TV in 2019. Sony bought Crunchyroll in 2017. In 2019, Disney acquired 21st Century Fox, which gave them a 30% controlling stake in Hulu. The Fox Corporation purchased Tubi in 2020. Amazon acquired MGM in 2022. Warner Media and Discovery merged to form WarnerBros Discovery in 2022.

Consolidation allowed these media conglomerates to exert market power in several ways.

Advertisement

First, the vertical integration of streaming distribution and content libraries provided media companies economies of scale, allowing them to push larger libraries of content to a larger body of paying viewers.

Second, consolidation decreased competition by absorbing or merging several smaller streaming platforms into fewer, larger offerings. Dozens of smaller streamers have been acquired and either sunset or merged into bundles. Decreased choice increased the few remaining firms’ pricing power.

Third, speaking of bundling: oh boy is it back. Bundles allow media companies to increase incremental revenue from price-sensitive customers and spread individual channel programming risk by offering a broader range of content at a standard price. Verizon bundled telecom with Disney+, Hulu, and ESPN+. Amazon offers Showtime and Max subscriptions, for additional monthly fees, through Prime. You can now bundle Disney+, Max, and Hulu for $30 a month. Bundling, which underpinned the traditional cable package, is now streaming standard practice.

Decreased originals, more licensing

Media companies’ original content spend peaked in 2022 with studios producing more than 1,500 original content pieces at approximately $238bn of total content spend.

These astronomical spend levels were driven by the era’s ‘streaming wars’, where a dozen platforms frantically competed for subscribers by releasing original content. Amid unprecedented (and, it turns out, unsustainable) levels of content investment, the Hollywood guilds decided to do the studios a favor and go on strike.

Competing studios, now equally starved of original content, shifted to compete on cost cutting via cheaper unscripted series and licensed content. Post-strike, average per-series budgets have declined, number of ordered originals declined, and total investment in content, including licensed content, only increased by 2%. In 2024, original content is estimated to be a third of 2022 levels, at roughly 500-600 new original series.

In place of originals, streaming TV has turned to sports licensing as traditional TV bleeds dollars and long-term league contracts come up for renewal. Now, sports licensing streaming investment is projected to increase by $30bn. Amazon has gobbled up Thursday night NFL games and Nascar. Peacock streamed the Olympics. Netflix, Disney, Apple, and Max are bargaining for NBA rights.

Advertisement

Enter advertising

Haters said it would never happen, yet advertising has made a triumphant return to TV.

YouTube was the only ad-supported streaming video option for years. Disney, Amazon, Netflix, and others have quickly gained ground, posting double-digit advertising revenue growth, quarter over quarter.

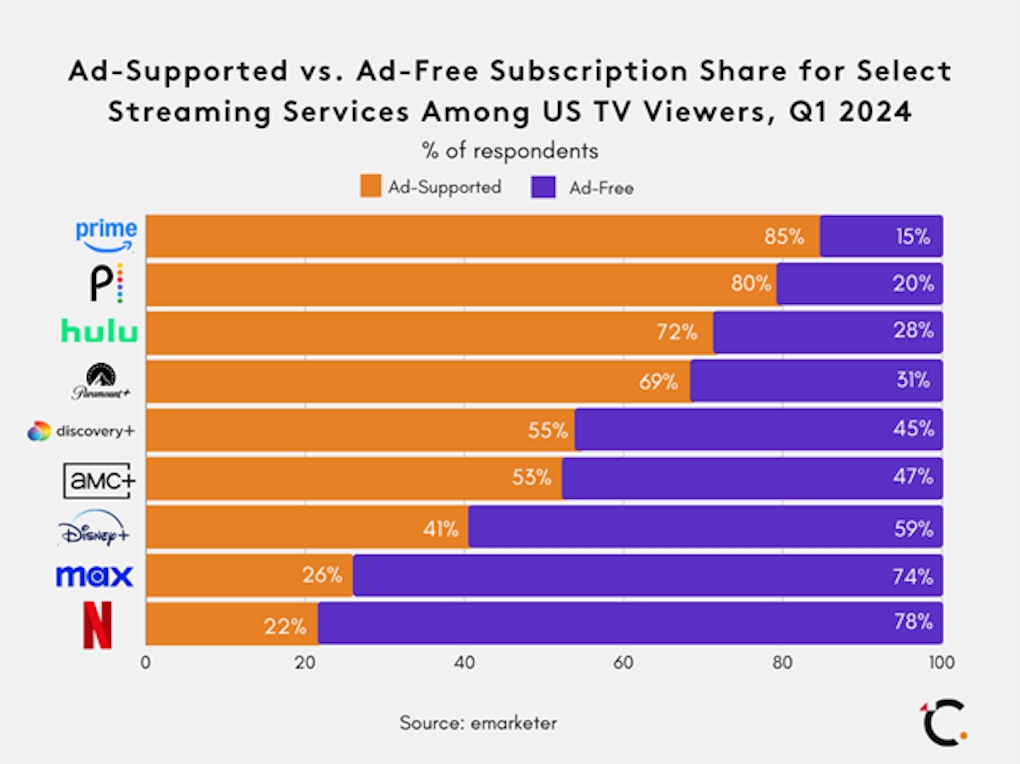

Advertisers have long hungered for more streaming inventory, as those audiences represent the youngest and most valuable cohorts of impressionable consumers. 67.9% of gen Zers watch Netflix, 89.3% YouTube, and 44.7% subscribe to Disney. Their lower spending power makes them more likely to opt into ads to save on out-of-pocket costs.

The distribution of advertising versus ad-free users varies wildly. 85% of Amazon Prime Video viewers now watch ads, followed closely by Peacock at 80% and Hulu at 72%. Advertising has supercharged streaming because it allows media companies to price-discriminate, broadening their total addressable audience to both lower and higher income brackets.

For now, streaming TV ad breaks remain shorter than traditional TV, averaging approximately 2 minutes. However, consumers should expect ad loads to increase as streamers, armed with more robust viewership metrics, squeeze more dollars out of programming. The ad load will increase until streaming TV platforms see a negative effect on consumer churn.

Our favorite streaming services will now come with advertising standard, just like cable subscriptions.

What’s old is new again

Media conglomerates have cracked the profitability code for streaming TV, a business model transformation that more resembles the traditional cable bundle each day.

Subscription prices have now exceeded $100 a month (and more for those who want live sports). Fewer options exist in-market, as media conglomerates have bought out the competition and bundled services to achieve economies of scale. Original content production has plummeted as media companies opt for cheaper licensed and live sports programming to fill schedules. Coupled with subscription revenue, advertising has returned with a vengeance, gracing TV glass again and juicing profits.

The days of dizzying levels of consumer entertainment choice and low costs have vanished. Welcome to the new normal: the TV packages of yesterday, now in digital streaming form.

Content by The Drum Network member:

Creativ Strategies

Creativ Strategies is a full-service marketing consultancy and studio for media, entertainment, and tech brands. Challenges welcome.